Excitement About Insurance And Investment

Wiki Article

An Unbiased View of Insurance Asia Awards

Table of ContentsGetting The Insurance Account To WorkInsurance Quotes Fundamentals ExplainedThe Greatest Guide To Insurance Asia AwardsIndicators on Insurance Ads You Should KnowNot known Details About Insurance Asia Insurance Asia Awards Fundamentals Explained

Handicap insurance can cover long-term, short-lived, partial, or total special needs. It does not cover clinical treatment as well as services for lasting care. Do you need it? The Center for Illness Control and also Prevention states that nearly one in four Americans have a special needs that influences significant life occasions, that makes this sort of insurance sensible for every person, also if you're young and also solitary.

Life Insurance for Children: Life insurance exists to replace lost earnings. Accidental Fatality Insurance Policy: Also the accident-prone needs to avoid this type of insurance policy.

These are the most vital insurance coverage types that give huge monetary alleviation for extremely sensible situations. Outside of the 5 main types of insurance policy, you must think thoroughly before acquiring any type of added insurance coverage.

Some Known Details About Insurance Agent

Bear in mind, insurance coverage is indicated to shield you and also your finances, not hurt them. If you need assistance with budgeting, try using a bill payment tracker which can aid you keep every one of your insurance policy payments so you'll have a much better grasp on your personal funds. Related From budget plans as well as expenses to complimentary credit history as well as more, you'lldiscover the effortless means to stay on top of everything.There are many insurance policy choices, and several monetary specialists will claim you require to have them all. It can be difficult to establish what insurance coverage you actually need.

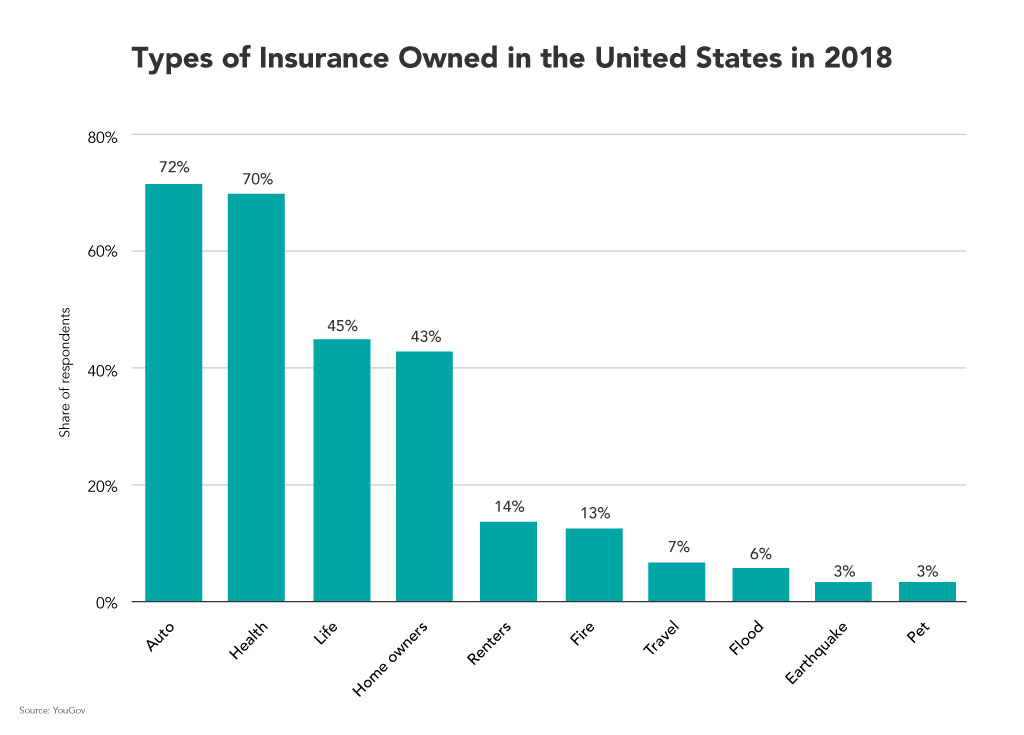

Variables such as youngsters, age, lifestyle, as well as work benefits contribute when you're developing your insurance policy profile (insurance and investment). There are, nonetheless, four kinds of insurance coverage that the majority of economists recommend we all have: life, wellness, auto, and long-lasting handicap. 4 Kinds Of Insurance Everyone Requirements Life insurance policy The biggest advantages of life insurance policy consist of the capacity to cover your funeral expenditures and offer those you leave.

Some Ideas on Insurance And Investment You Should Know

The two standard types of life insurance policy are conventional whole life as well as term life. Simply clarified, entire life can be used as a revenue tool along with an insurance coverage instrument. As long as you continue to pay the regular monthly premiums, whole life covers you up until you pass away. Term life, on the various other hand, is a policy that covers you for a set quantity of time.

Often, even those employees who have terrific medical insurance, a great savings, and also a great life insurance plan do not get ready for the day when they might not be able to help weeks, months, or ever before once again. While medical insurance pays for hospitalization and also clinical expenses, you're still left with those everyday expenses that your paycheck normally covers.

Get This Report on Insurance Advisor

Numerous employers use both short- and long-term disability insurance as component of their benefits bundle. This would be the very best alternative for safeguarding budget friendly disability coverage. If your employer doesn't provide lasting coverage, right here are some things to think about prior to acquiring insurance policy by yourself. A policy that guarantees income replacement is optimal.7 million vehicle crashes in the U.S. in 2018, according to the National Highway Traffic Security Management. An estimated 38,800 people passed away in auto accident in 2019 alone. The top reason of fatality for Americans in between the ages of 5 and 24 was auto crashes, according to 2018 CDC data.

The 2010 financial expenses of car mishaps, including fatalities and disabling injuries, were around $242 billion. States that do call for insurance coverage conduct periodic random checks of drivers for evidence of insurance policy.

A Biased View of Insurance Commission

If you drive without car insurance coverage and have a crash, fines will possibly be the least of your financial worry. If you, a guest, or the other motorist is hurt in the mishap, auto insurance coverage will certainly cover the expenditures and also help protect you versus any kind of litigation that may result from the crash.Again, similar to all insurance, your private scenarios will certainly identify the cost of car insurance coverage. To ensure you get the ideal insurance for you, compare a number of price quotes and also the insurance coverage given, and examine occasionally to see if you receive reduced prices based upon your age, driving document, or the location where you live (insurance agent job description).

If your employer does not supply the kind of insurance coverage you desire, acquire quotes from numerous insurance policy suppliers. While insurance is costly, More Info not having it can be far much more costly.

The Best Guide To Insurance Meaning

Insurance is like a over here life coat. It's a little bit of a problem when you don't require it, but when you do need it, you're greater than happy to have it. Without it, you can be one automobile wreck, ailment or residence fire away from drowningnot in the sea, however in financial debt.Report this wiki page